Moving into a brand-new home? It’s exciting times! That smell of fresh paint and woodwork, echoes of empty rooms before the furniture rolls in and the dreams of hosting friends and relaxing with family. There’s no better feeling than moving into a brand-new home that you can call your own.

However, to make the most of your new home and extend its life for future generations, there are a few basic maintenance tasks you will need to attend to regularly. We encourage all owners of McCarthy Homes to read this brief guide to get an idea of some of the things you should be thinking about when you move into your new home, both on day 1 and into the future.

Concrete

Taking care of concrete can be a little difficult. Unfortunately, even the best laid concrete can crack under the right conditions. At McCarthy Homes we do everything we can to ensure that any concrete we lay on driveways or paths is right for the environment. To take further steps to ensure your concrete goes the distance, be wary of having heavy vehicles park or drive on it and don’t undertake extensive digging nearby. Consider planting trees further back from any concrete as well, as roots can quickly crack and distort concrete.

Decks and Exposed Wood

If you’ve just taken delivery of your home, one of the first things you will need to do is coat all wooden decking with sealant. This will help maintain the integrity of the wood in all weather conditions. It will help seal out water and may provide a barrier of protection against other damage. Over time, you may find that your deck attracts dirt and stains. You’ll need to scrub it down thoroughly and reseal it on occasion to keep it in pristine condition.

The same rules apply for other exposed wood around your home. Ensure that new sealant is applied as needed. Pay particular attention to wood that is directly exposed to the elements, particularly sunlight and rain.

Condensation

While many modern homes are built with extractor fans and are designed to promote adequate air flow, you will need to take some steps to prevent condensation forming in certain areas of your home. Basic steps you can take to reduce condensation include opening bathroom windows when water is in use and using extractors and ventilation systems. Limiting the ability for condensation to form inside your home will also help prevent any mould growing.

Flooring

Depending on the flooring in your home, you may need to take different steps to maintain it at a high level of quality. Carpet should be vacuumed regularly, preferably with a vacuum cleaner that’s appropriate for its thickness and conditions (if you have pets, consider a vacuum cleaner with an attachment for pet hair). Carpets should be shampooed roughly every two years, or less, to ensure they stay clean and stains don’t become set in.

Wooden floor boards may need to be polished at times. If mopped regularly, they may also need to be polished and have new varnish or sealant applied. Tiles and linoleum should be mopped regularly. Be wary of uneven wear on some parts of your flooring. This can arise due to heavy foot traffic or furniture footings.

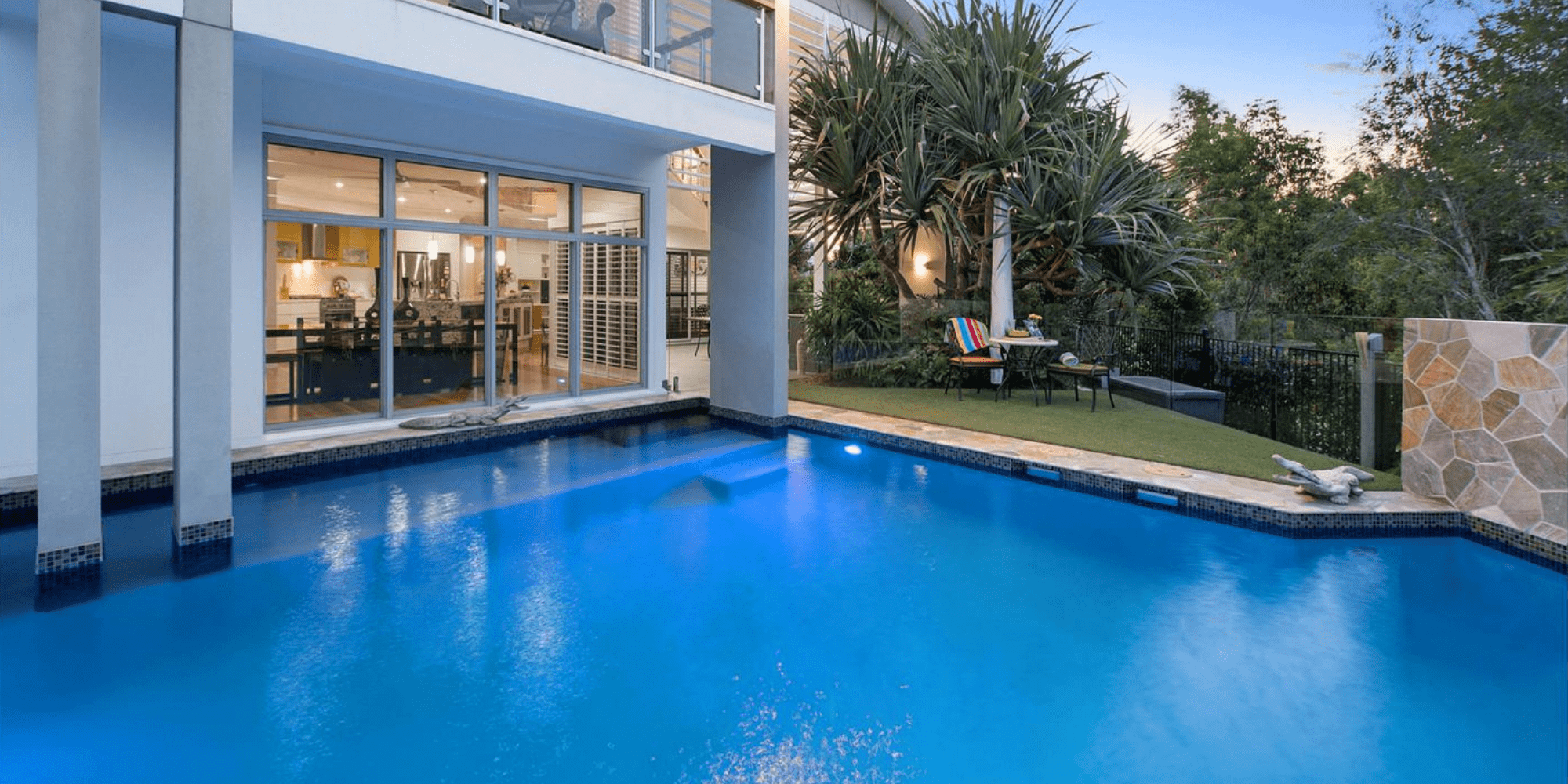

Gardens and Pool Areas

If your brand-new home was built by us, we will provide guidance on landscaping and gardening that will assist you in maintaining the integrity of your home. Some things to be aware of include:

• Ensure that all gardening, soil, additional tiling or paving etc is located beneath the level of the damp proof membrane.

• Ensure that nothing covers the weep holes in brickwork.

• Aim for a 75mm split between your gardens, gravel, soil and grass and the weep holes.

• Weep holes must be kept open and able to be visually inspected as part of termite prevention, in addition to protecting brickwork from moisture.

Your pool areas should be maintained according to your local council guidelines. You should ensure that they do not sit above the level of your home and that there are adequate measures in place to ensure that all excess water drains away from your home.

Maintenance advice

If you are unsure how to maintain any part of your home and would like professional advice, please contact us. We always seek to ensure that our clients are provided with adequate information at handover, however sometimes some eventualities arise which cannot be planned for. We’re more than happy to point you in the right direction if required.

Or, call us on (07) 3358 9704